In this article, you will get to know about the following things-

What is NPS? Why invest in NPS?

When to start saving for your retirement? FAQs about the NPS account How is the structure of NPS Who are the NPS Pension Fund Managers Who are the NPS Annuity Service Providers Where does NPS invest What are the Investment choices under NPS? What is an Active choice under NPS? What is an Auto choice under NPS? FAQs about Investment Choice under NPS When can I Exit from NPS? Can I withdraw partially from the NPS Account? What are the types of accounts under NPS? What is the Taxation category of NPS? What are the Tax Benefits of NPS?

Now let's go back to equity where I was talking about a maximum of 75%. But here there is one more rider who says that 75% is okay up to the age of 50. When your age goes above 50, now have a very careful look at this table up to the age of 50, a maximum of 75% You can have, but as in how your age goes on increasing, you can see that the cap on equity goes on reducing by 2.5%. What is the thought process behind this? Older you get your risk-taking capacity decreases? And that is the reason why you can see that the proportion given to equity is going on and reducing. Is this clear? Let's move on to the second choice, which is your auto-choice. In simple words. Now the demand Nila running ERP, three choices are given to you it's very easy. Either you choose an aggressive lifecycle. Either you choose a moderate, or you choose a conservative lifecycle fund. So these are basically the three types of funds. I think the name itself suggests aggressive, moderate, and conservative.

IMP Links- Pension Calculator

Take another look at this huge table. No, because the table is so large, we'll merely concentrate on the age range of 35 and under. Therefore, if I proceed with an aggressive lifetime fund, at most 75% will go into equity. Equity may go as far as possible. Government securities will have a maximum yield of 15%, and up to 10% for CSR plus corporate bonds. Please have a look at the aggressive equity range of up to 75% in the II column. Take a look at the modest lifecycle table in the next row. If you recall, the equity in the prior moderate lifecycle fund was 75; this year, it is down to 50. The remaining C and D are then 30, 20.

The final one is moderate. Of course, should the equity component decline once more. Yes. And for that reason, it sank earlier. It was 75. It decreased to 50. And because I'm being prudent, it's just 25%, with increases to C and G of 45% and 30%, respectively.

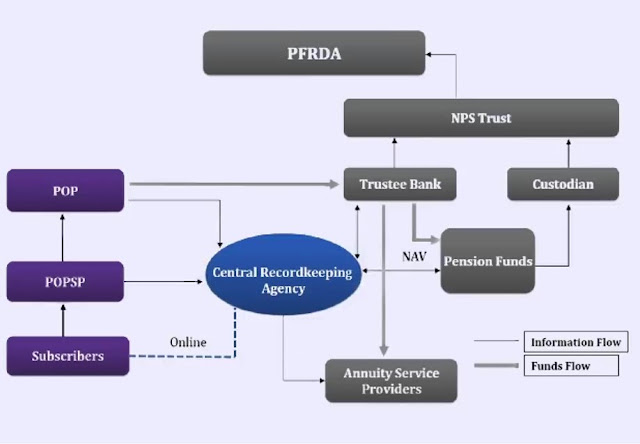

How is the structure of NPS?

Switching Modes and pension fund?

I feel that you might have one question in your mind. And what is that? I understood about auto mode and active mode. But if I want to do my job check them at a high level. I said I'll manage it on my own actively. And then you feel that it's enough. I'll switch to auto mode. Can you switch it later? The answer is yes. In fact, you're allowed to switch from auto to active twice in a financial year. So the time major time Pascaline switched cars, was in the bread sector. Okay, anyways, if you want you can also switch between two types of autos. If you remember one was aggressive and one was conservative in auto. Can you switch between this aggressive and conservative also? Yes. How many times twice in a year? One more question. Can I change the pension fund that I've opted for Remember I told you the list of pension funds? Yes. Can I change the pension fund? Yes, but how much only once a year.

Exit rules

Now, let's understand the exit rules. But for that have a look at this table very carefully, you can see that exit before the age of 60 or should exit at the age of 60 years, if you want to withdraw or if you want to exit before the age of 60 years, there is a condition that at least 10 years should have passed since you opened the account. So just as an example, if I start investing at the age of 35, in NPS, I should have completed till 45 years of age, then I can go ahead with the exit rules. So the very first one is before 60 years of age second one is after 60 years of age. Let's understand what are the two points here? If I'm before in the category of before the age of 60 How much can I withdraw up to 20% of the corpus can be withdrawn in a lump sum? So assuming that I have one crore as a total corpus I can withdraw how much maximum of 20 lakhs. If I'm talking about exiting at the age of 60, how much can I withdraw in a lump sum maximum of up to 60%? So, in our example, one crore or corpus or two I can withdraw the maximum of 60 lakhs correct both cases one point is common whatever remains is going to be converted and invested into an annuity.

Next, you can completely withdraw your funds without having to purchase an annuity if your corpus in the first scenario was equal to or less than one lakh. The same issue applies when you reach the age of 60. Just that the amount is now two lakhs each year rather than one lakh. Now, I can also have some falling flexibilities if I desire to leave the NPS at the age of 60. However, you can only read these flexibilities if you are willing to delve deep. It's quite simple.

Partial withdrawal

Now let's go to the partial withdrawal. What happens in partial withdrawal is that you can withdraw a certain amount and still continue to be a subscriber to NPS means what if I withdraw a specific percentage is it necessary that I have to close NPS No, I can withdraw a small part and still I can continue to be a part of this NPS scheme. But again, there are certain conditions what are the conditions? When can I partially withdraw number one, it's the subscriber should be in NPS for at least three years in simple words, the day I started NPS I should be in the scheme for a minimum of three years only after that I can partially withdraw my amount from NPS account second one withdrawal amount will not exceed 25%. Again let's take an example assuming that I have one crore rupees maximum how much can I withdraw partially maximum of up to 25 lakhs. The third one is a maximum of three times during the entire tenure. So I can't keep on withdrawing from the account. And again the last one is withdrawal is allowed only for specific reasons like higher education of children child marriage, and marriage of children.

Types of NPS account

Now you can see that there are two types of NPS accounts one is a tier one account and one is a tier two account. Oh my god Now what's that simple, whatever we learned till now was a tier one type of account even if you read out the features, you will understand that what they were we discussed till now was a tier one type of account. Then what is a tier two account? Those who want to go ahead with NPS not only from a retirement perspective, not only from a tax saving perspective, but they want to go ahead for savings or they're looking at this as a different investment. For them it's a tier two account, So, just as an example, some person feels this is like a mutual fund only. But in this in this type of mutual fund NPS, I can choose I want an auto strategy, or I want some inbuilt studies, or I want to go out for an aggressive strategy, or conservative strategy, some person gets fascinated by this. Can he or she go ahead with this option just for investment purposes? The answer is yes. And this is nothing but your tier two account. But in this tier two account, you will not get any tax benefits. There'll be no locking there will be no restriction on withdrawals. But always remember, you can open a tier two account if and only if you have a tier one account.

Now one last point about the tax benefits, which I said I'll talk about, please understand this last one and read it very carefully. Earlier when NPS was introduced, it was in the EEE category. What is EEE first is exempt. You get an amount exempt when you invest in NPS next E whatever income is accrued is generated from that NPS would have been exempt secondary. Third, whenever you withdraw the amount that also is exempt. So EEE is Exempt from investing Exempt on income accrued and Exempt on final maturity proceeds.

Now the government has changed its status to E and partiality. What is this E partiality? Again, it's a bit tricky. It is only for those who really want to dig deep. You can again have a look at this chart. There are two sections section 10 12 A section 10 12B.

10-12A and 10-12B will be talking about how much exemption will be available and how much it will be taxed.

What are the Tax Benefits of NPS?

Let's understand the tax benefits of NPS In short, the very first thing you should know is that for NPS investment if you're doing you can claim a deduction of up to two lakh rupees under various sections but how do let's understand first our normal ATC section but in that, you have to take into account ATCCD 1. There are again certain conditions here please have a look at this 10% of basic or 1.5 lakhs whichever is lower.

Second very important ATCCD 1B you get a deduction of an additional 50,000 I'll give you my own case. Read carefully. Do I have ancillary income zero I own business income? If I put two lakh rupees in NPS will I get a deduction? Yes, First one lakh 50,000 of ATC I will get an additional 50,000 of ATCCD 1B I will get. So as a business person, I do get a deduction of two lakhs from NPS.

Additionally, there is something called ATCCD-2, which does not apply to me because it only applies to employees whose employers make NPS contributions. I strongly advise you to speak with your chartered accountant before making an NPS investment since, believe it or not, the taxation of NPS is highly complicated. It is changing. Every now and again, the government creates new laws, rules, and changes. Therefore, it is best to seek good counsel from your accountant before proceeding with the taxes of NPS.

Capital Gains

The answer to the following question is no, there is no tax on capital gains. What about withdrawal, as the third question? On the previous slide, we discussed partial withdrawals. If I'm referring to annuities, they are taxed according to your tax slab rates.

%20b.jpg)