I welcome you all to another interesting blog where we are going to talk about three terms, which are very important for any person who is in employment.

The first one is CTC, the second one is gross earnings or the gross salary and the third one is net salary, sometimes referred to as your in-hand salary. But what is the meaning of these three terms? Are there any components in that? What is the tax angle to that All this coming up in the immediate next parts of the article.

What is CTC?

CTC is nothing but a Cost to the company. It's the amount that the employer is willing to pay to the employee, but it's not necessarily the amount that the employer is going to receive in hand. What's the example for this? Let's say I offer you a salary. And assuming that I offer a CTC of 18 lakh rupees, does it necessarily mean that you're going to get 18 lakhs divided by 12 which is 1.5 lakh in hand per month? The answer is no because your CTC can have multiple components okay which components what we are going to discuss in the subsequent parts of the article, but I'll give you a very short example right now it says to assume that as split your 18 lakhs, etc As 12 lakh fixed and six lakhs variable. Now, this six lakh variable I may term it a performance bonus. Now, assume that you are not able to meet your targets and out of six lakh the actual payout comes to only let's say four lakhs because assume that you are out of 100% you're able to achieve only 75% of your target or something like that, okay. So, in that case, what will happen out of your six lakh performance bonus which was a part of your CTC, the actual payout might be lesser than that, it might be let us say only for like, in that case for that specific year, can I say your CTC dropped down from 18 lakhs toward to 16 lakh only, okay, because you lost out on the two lakh of performance bonus. So that is how I can tell you that CTC is always a bigger number as compared to what you're going to get in hand. In certain scenarios, it might be more or less equal, but it can't, it just can't happen that your enhanced salary will ever exceed the CTC.

Let's take an example and understand what could be the possible splits that could be the different components of CTC, before we proceed with the example please understand that this is just an illustration. This is just an example. Whatever allowances I'm going to discuss in this example right now, it's not necessary that your employer will give each and every one of the loans that I'm discussing in this example, there could be some plus-minus to this as well.

So let's understand this is an example wherein a specific employer says that what is going to form a part of your CTC can be basic salary, HRA that is your house rent allowance, children's education allowance leave travel allowance, very commonly known as LTA, medical allowance, special allowance, gratuity, employers contribution to pF, all these put together a total 4,38,000 This entire thing will form a part of your CTC. As mentioned, could there be a company which doesn't offer any special allowance? Yes. Could there be a company which has some other allowance rather than other than all these whatever I've discussed right now? Yes, absolutely possible. So you have homework today won't check your offer letter and see which all allowances are you getting? are the same or some different allowance you're getting right. Now understand. There is one specific point here I've taken a subtotal which is your gross salary.

What is this gross salary?

4,08,200 this gross salary is going to be very close to what you're going to get in hand. So what is the difference understand your CTC is for like 38,000 something but your gross salary for 408000 Something, which is going to be very close to her enhanced salary not for like 30,000 It's gonna be for 4,08200 that is going to be close to her in hand salary.

Two components missing from gross salary -

1) Gratuity

2) Employer's contribution to PF

I'm sure you might be aware of this basic thing that a certain percentage is fixed set 12% Okay. So, the employer contributes 12% employee generally matches it okay. So, employee, you will also contribute 12%. Employer contribution will not be paid out to you every month that will go to a pool okay. And whenever you leave the organization or let us say on retirement, whatever is the case at that time it will be paid out to you okay, but even a forms part of your CTC will not form a part of your gross salary. I hope you have understood we are trying to shift from what to what, from CTC to gross salary. I hope the difference is absolutely clear.

Payslip

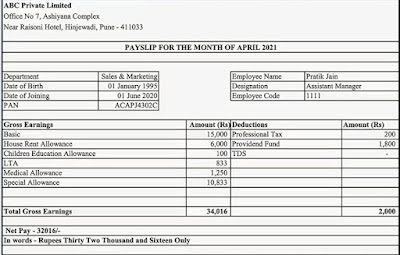

Now, let's try and decode the payslip but before we move on to that, We have two columns one was a PA per annum amount and one is PM, which is the per month amount, okay. Now, we can see that the gross salary per month was around 34,916 rupees and the CTC was 36,538 rupees. Now, the million-dollar question to you is out of these two figures, which figure will appear on your payslip? What is your answer ARB 34,016 or 36,538? And the correct answer is 34,016. So if you want to check this in your pay slip, just have a look at this pay slip now. What do you see there is one sub-total which says your total gross earnings or is nothing but your gross salary of 34,016. Now, what is the split of this?

Let's understand the split first one is basic salary. So out of your 34,000 rupees, your basic salary is only 15,000 rupees. Don't feel that, this is even less than half of your gross salary doesn't make a difference as such. In fact, your basic salary is 100% taxable, okay, you don't get even one rupee deduction out of that. So even if it is less, you should be happy with that. Okay, so that's a basic salary. Now, if you look at the other points in your payslip, what are these other points, house rent allowance, children's education allowance, LT medical allowance, and special allowance? I'm taking some creative Liberty here. If I look at these allowances, it's as good as an employer taking full care of the employee. Okay, how the employer is giving you a basic salary employer is ensuring that the employer pays for your house rent of yours by giving you a house rent allowance. So taking care of your accommodation, taking care of your children's education alone, so taken care of your kid's education to some extent, taking care of your leisure travels by giving you an LTA. Taking care of your medical allowances, and student care of your health.

If you look at the right-hand side deductions, taking care of your retirement in the nature of PF, see how good employers are. But anyways, all in all, finally, it's nothing but just a breakup of your total gross earnings, which I'm showing you in the nature of the payslip. Are there any tax angles involved here? the answer is absolute yes. I'm not going to go into detail about tax angles. Why?, because this is not a taxation article. This is just understanding the payslip. So, just to give you a brief idea on this as I mentioned, basic is a fully taxable basic salary fully taxable house rent allowance, may or may not be fully exempt depending on certain conditions. So if you want to read if you want to understand on Well, there are basically three conditions, which we have to check and the least of the following is a big calculation which is what if you want to check this understand HRA with the help of a proper example, check out our blog, which we have written on HRA. So in simple words, it may or may not be fully exempt, depending on certain conditions.

Children's education allowance

Now, if this is a very big, big humor or big joke, why I'll tell you, suppose my child's fee annual fee is around 50,000 rupees per year.How much is the exemption or the deduction which is available? It is 100 rupees per month. Okay, subject to a maximum of two children 100 Amaretto. So how much exemption am I going to get? 100 multiplied by 12. Okay, multiplied by two is not standard, if I have only one child or only multiplied by one, okay, so out of the 50,000 rupees that I've paid 1200 rupees I'm going to get as a deduction. Okay? It's a joke, but yes, that is how much maximum is going to be allowed as a tax exemption for you. Well, I'm using the words deduction and exemption interchangeably right now. It's not correct. We are not good. This is not a taxation article. Right.

What is LTA?

Moving on, what is the next one forming a part of your payslip? That is your LTA- Live and travel allowance. So basically, as I mentioned, the employer says, don't only work have fun and come fully charged up and then work double right that is the expectation of the employer. Now, there are certain rules and regulations involved again, how much can be exempt from the LTA that you receive, just to give you a few examples, if you travel outside India, that will not be allowed as a deduction if you're going ahead with claiming a benefit for LTA. Who can accompany you that is also very important. Otherwise, if you're saying or I want a whole deduction it will be like everyone is going A B, C, D, E, F G H, and everyone will not get that entire amount will not get you will get as a deduction. Again, who is covered? What is the definition of relative everything is given in the section, if you really want to read the sections, I'll give you links in the description below? All yours, you can read the entire bear section also and get to know more about it, but I'm just going to give you a brief flavor about it. Okay, so that was about LTA

Medical allowance

Moving on to that, that is also pretty close to basic salary as far as the taxation is concerned because whatever medical allowance you're gonna get, there's going to be fully taxable, special allowance differs from company to company, it can be a car allowance, it can be a driver allowance, it can be a Coca Cola, whatever, it can be any sort of allowance, internet allowance, very creative it can be.

So I hope you understood that if I add up all these together, this amount of 34,016 is going to be your total gross earnings. Is this what you want to get in hand? No. From this amount, there'll be certain deductions, which deductions? What is the meaning of that that is going to come up in the next part of the article?

Different Deductions in salary

So let's understand what could be the different deductions again, have you look at our pay slip? Could there be only three deductions for each and every employee? No, in some companies, deductions could be more than this or could also be less than this. These are the deductions in our example, right. So let's understand these deductions one by one,

1) Professional tax.

Generally, 2500 rupees is the amount of professional tax that has to be paid, but what does the employer do employer cuts 200 rupees per month from your salary and pays it, but in the month of February 300 rupees will be deducted from your salary. So, 200 into 11 = 2200, and 300 in the month of February will take you to a total of 2500 rupees per year, right.

2) Provident Fund

Now, what is this provident fund? This is the employee's contribution to Provident Fund, if you remember we talked about the employer's contribution to the provident fund okay. So, this will be generally the same. So, say 12% was contributed by the employer same proportion will be contributed even by the employee and this employee's contribution will reflect in the deductions that come out right.

3) TDS

This TDS is nothing but your income tax. So, employers will cut tax at source and will pay to the government okay. Now, as homework what you can do is take out all your payslips take the total of TDS, and see whether this total tedious matches your form 16. Ideally, the total should be saved in form 16. There is one more form where you can cross-check the amount of TDS and I want you all to tell me in the comment section, which form is I hope with this you have understood all the deductions which were visible in your payslip.

Net salary

So in simple words to round it up again. What was the scenario? First, we talked about the CTC from that we derived the gross earnings and from gross earnings we add certain deductions and came down to the Net salary or your in-hand salary.

Thank you 😊